-

- Home

- About Us

- Attorneys

- Divorce

- Uncontested Divorce

- The Illinois Divorce Process

- Division of Property and Assets

- Complex Financial Situations

- Theft/Dissipation of Marital Funds

- High Conflict Divorce

- Spousal Support

- Divorce for Older Couples

- Tax Considerations

- Child Custody / Parental Responsibilities

- Child Support

- Post-Decree Order Modifications

- Family Law

- Blog

- Scholarship

- Media

- Testimonials

- Contact

Sorry, the page you are looking for does not exist or may have moved.

Contact us via phone at 312-884-1222 and we will be pleased to answer all your questions.

Practice Areas

- Family Law

- Divorce

- Uncontested Divorce

- The Illinois Divorce Process

- Division of Property and Assets

- Complex Financial Situations

- Theft/Dissipation of Marital Funds

- High Conflict Divorce

- Spousal Support

- Divorce for Older Couples

- Tax Considerations

- Child Custody / Parental Responsibilities

- Child Support

- Post-Decree Order Modifications

Recent Blog Posts

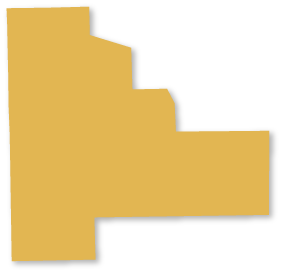

Serving Counties Across Illinois

From our offices in Downtown Chicago & Park Ridge, we serve clients throughout Cook County, including the North Shore and the Northwest Suburbs of Schaumburg, Arlington Heights, Mount Prospect, Des Plaines, Inverness, and more. Our services also extend to surrounding areas in DuPage County, Lake County, Kane County, and Will County.

Cook County

DuPage County

Kane County

Lake County

Will County

312-884-1222

1580 N. Northwest Highway, Suite 12, Park Ridge, IL 60068

1580 N. Northwest Highway, Suite 12, Park Ridge, IL 60068

From our offices in Park Ridge and Chicago, we serve clients throughout the Chicagoland area, including but not limited to Cook County, DuPage County, Harwood Heights, Rosemont, Schaumburg, Des Plaines, Elmwood Park, Norridge, Schiller Park, Lincolnwood, Edgewater, River Grove, Austin, Niles, Morton Grove, Skokie, Norwood, Logan Square, Bucktown, Oak Park, Wheeling, Hoffman Estates, Rolling Meadows, Palatine, Cicero, Evanston, Northbrook, Mt. Prospect, Elmhurst, Glenview, Humboldt Park, and the Loop, as well as Naperville, Wheaton, Lombard, and Glen Ellyn.

Contact Our Firm

The use of the Internet or this form for communication with the firm or any individual member of the firm does not establish an attorney-client relationship. Confidential or time-sensitive information should not be sent through this form.

I have read and understand the Disclaimer and Privacy Policy.

312-884-1222

312-884-1222